Payroll Services

Payroll Services

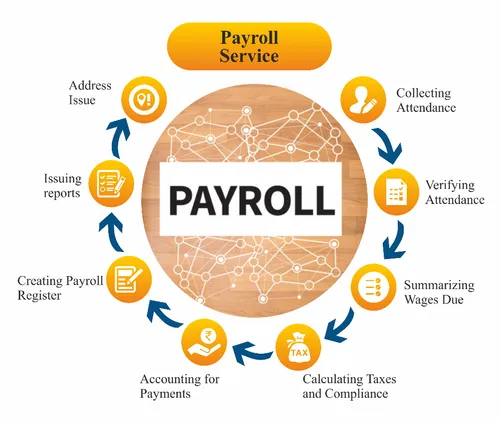

Payroll is concerned with the financial records of salaries, wages bonuses, allowances and deductions of employees in an organization. Do you need a payroll solution for your business in Telangana? Then get best-quality payroll services tailored to your needs. Our team of experienced professionals with extensive knowledge relating to payroll services who can provide you with full-fledged payroll services effectively and efficiently and hence noted as one of the most-trusted payroll consultants in Telangana. We at RJ Consultancy Services are passionate about providing comprehensive payroll processing services for small, medium and large organizations.

- Verifying Attendance

- Wage Sheet

- Loans, Advances and Uniforms Deduction

- Checking Leave Management

- Checking EPF, ESI and PT as per salary structure

- TDS Deduction

- Employees Pay slips

- Manage Employees Master data

- Preparing Auditing Documents as per the Client

- Bonus

- State L W F

Attendance Register

Employee Attendance Registers is used to maintain records of the presence, absence, sick leave, etc related to each employee for payroll/salary purpose. It consists of records of payroll heads like the present, absent, late comings, holidays, job training and all other kinds of leaves used to calculate the salary.

Wage sheet

A wage sheet is a document that lists an employee’s wages, hours worked, and deductions for a specific pay period. It is usually used to record payroll information for an employee or group of employees. A wage sheet includes the employee’s name, hours worked, regular and overtime wages, deductions, and net pay.

wages sheet is usually prepared by the payroll department or an external accountant. It is a document that lists all the wages associated with the employee’s net pay, deductions, and taxes.

Salary arrears

Employee Salary arrears are complex. HRs need to calculate multiple complex parameters to ensure that arrears are paid on time. Whenever there was a delay in payment of employee salary or miscalculation, it needs to be paid in arrears.

However, it is easier said than done since these arrear calculations require manual calculations depending on each scenario.

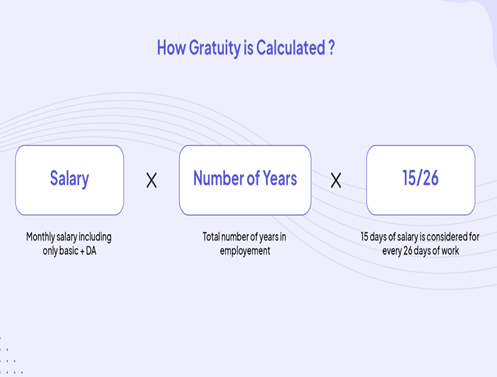

Gratuity

Gratuity is a lump sum amount that employers pay their employees as a sign of gratitude for the services provided. The gratuity rules are mandated under the Payment of Gratuity Act, 1972. The act was passed by the Parliament on 21st August 1972 and came into force on 16th September the same year.

All central and state government departments, defence, and local governing bodies are covered under this act. Private organizations can come under its purview subject to fulfilment of certain conditions.

Employees have to complete 5 years of service to be eligible

To be eligible, an employee has to render his/her services for 5 continuous years. However, this condition is not taken into consideration in situations of demise or disablement of an employee.

For the calculation of the 5 years, a single year is assessed as 240 working days for employees working in organizations that do not involve work underground. For those working in mines and other such fields, a year is assessed as 190 days.

Leave Management

Leave Encashment

Leave encashment is the amount the employer pays their employees for unutilized leaves. The accumulated leave balance can either be availed during the service period or as the full and final settlement by the employees at the time of their retirement or resignation. According to the Factories Act 1948, the leave encashment and bonus amount shall be settled by the 7th or 10th of the following month after the employee’s resignation.

Casual Leave

This type of leave is most commonly availed by the employee. This leave can be taken for a maximum of seven days. However, it depends on the guidelines provided by the employer for each organization may vary. The employee has to inform the employer about the casual leave to be taken beforehand and mention the number of days or duration of the leave. It will be considered for leave encashment if it is allowed to be carried forward as per company’s policy.

Medical Leave

Employees availed of these leaves due to their medically unfavorable health conditions, making it difficult for them to carry out their work-related tasks partially or wholly. Once sanctioned by the employer, the pending medical leaves become eligible for leave encashment. The number of medical leaves allocated differs from company to company.

Maternity Leave

Leave policies must constitute maternity leaves to encourage gender diversity in the organization. All female employees on confirmed employment who are not covered under the ESI Act, 1948, and have completed 80 days of continuous service with the organization are eligible for Maternity Leave. A woman employee can avail of 26 weeks of maternity leave with wages / Salaries (8 weeks of leaves preceding the expected delivery date, and the remaining 18 weeks can be availed post-delivery). Suppose a woman employee does not avail full eight weeks’ leave preceding her delivery date. In that case, she can avail of that balance leave following her delivery, provided the total leave period, i.e., preceding and following the day of her delivery, does not exceed 26 weeks. Maternity leaves can be extended for a period the company decides on a case-to-case basis. However, the extended leaves are unpaid. Maternity leaves are not considered for encashment.

Sick Leave

An employee can call in sick if he/she is unwell and not in a state to go to the office for work. Usually, it is recommended to write a leave application letter in order to request for a leave. A medical certificate from a registered doctor or medical practitioner may also be required in case of a long period of absence due to sickness.